Looking back my Husband and I often say we wish we had been given better financial skills at a younger age. We both started working young, but it was never a requirement to put part of our earnings into savings, and we got in a rhythm of always covering the tab, and supporting friends with less cash on hand so they could come along and enjoy the fun.

This soon got old, and when we were looking to purchase our first home, we had to take a serious reality check. We couldn’t keep going, and still have a home and family.

So we hunkered down. Saturday nights were reno’s and a rented movie (you still did that then) and we saved our money and re-invested it into our home. And then we did it again.

And after a few years, we had great equity, but still not a lot of operating budget.

Oh, and we were tired, and unhappy.

So, we took our nest egg and we changed things. We ditched our support system, our jobs, our community and any stability we had created and we started new. Now, I am sure we could have done this without our savings after selling our house, but I don’t think we WOULD have. We had 3 kids, and we knew we wanted to find some sort of balanced life, and a forever home, and we needed some money to be able to do that. We took a chance, and our investments, and chased a dream.

They talk about financial health, and saving for those big dreams or unforeseen emergencies. I feel like our move was a combination of the two. We were chasing a dream, but were so unhappy with our current life that it was become dire to our health, our relationship and our sanity.

Without the saving we had done in our 20’s and 30’s, we never could have made this life change in our 40’s.

So now, into our 4th year of this “new life” and with a new mortgage, and “becoming” stable incomes, we need to get ourselves back on track of saving for the NEXT big thing. We have 3 kids coming up to university, weddings and other “expensive” moments in the next 15 years, not to mention that sneaking glimpse of retirement on the horizon. I know that not only do we want to be prepared for these upcoming events, we want to be able to, without stress and sacrifice, manage them.

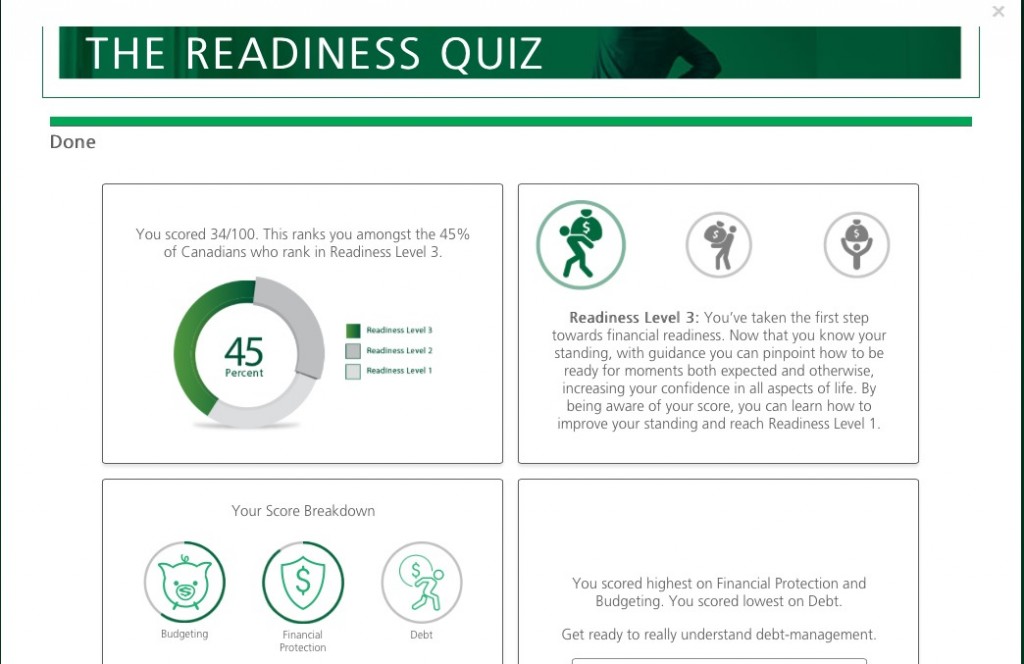

So, to knock some sense into myself, I took the manulife #LifeReady quiz.

And knock it did! While I am at 45% “ready” a lot of the questions reminded me of things that I had let slide. While yes I do have insurance and am prepared for the “worst” I may not be as prepared for the “uncomfortable” moments that may pop up. We have spent the last 4 years starting over and rebuilding, and our focussed shifted from the future to the immediate.

And while the immediate is fabulous, the future IS where it is at.

See, we worked long and hard to get a life we wanted, and we want to ensure that we keep it. We don’t want an accident or illness to hurt our life, and we want to build in the rest of the dreams on our list.

Its about being able to travel again, to the beautiful places we have been. Our last big trip was to St. Lucia, and it is time to save and do this again.

It was having them visit the different cultures, and experiences, and the every day, all day family time that is so wonderful and insane at the same time.

But our dreams also include this balance into the every day. Into find the quiet moments in our regular life, enjoy our island and exploring what it is has to offer. Our #LifeReady moments are all based around having choices, and it is time to start remembering that.

I am not one of the 28% of Canadians who feel #lifeready, but I am on the path to get there.

How are you doing? Take the test today and find out, and lets see if it inspires some dreams in your life?

Disclosure: This post is sponsored by 360ACCESS on behalf of Manulife. The opinions are our own.