Having a farm has always been my dream, and my husband’s too luckily enough. We have worked very hard to make that dream a reality, and have instilled in our children the concept that from work comes reward, be it personal or financial. The personal rewards are achieved daily on a farm, with the love we receive from our flock and hooved critters, their growth and health as we care for them. Moments where we just stop, lay in the meadow and soak up the sunshine and sounds of bees.

The financial rewards are less obvious, but still there. When time came for us to discuss money with the kids, both my hubby and I agreed we did not believe in handing out money to them for nothing. In the world, you just don’t get money for nothing, but earn it through hard work and creativity. We both felt very strongly about our children earning their own pocket money, and understanding the connection between effort, value and earnings.

Understanding the work it takes to EARN money, allows them to put into perspective how to SPEND it (and how quickly it can go).

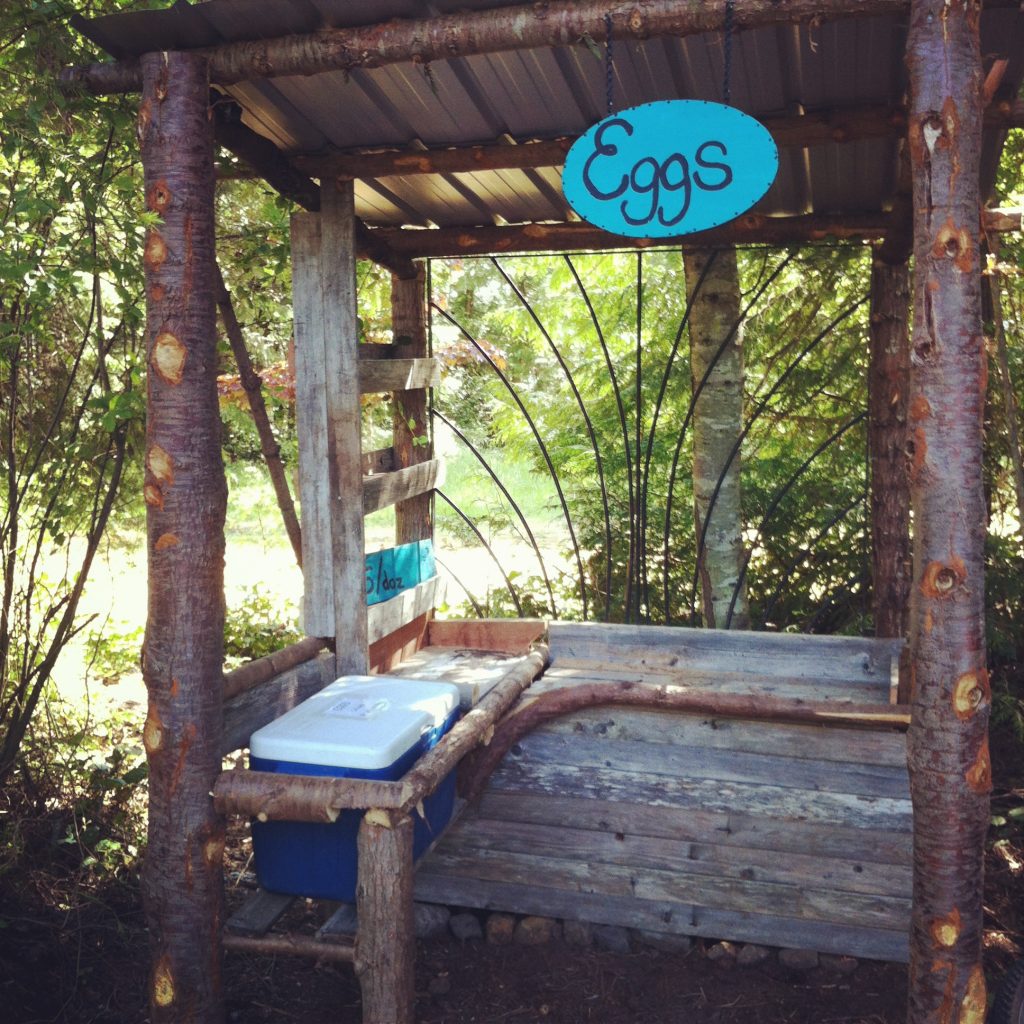

On a farm with chickens and a large garden, there is a bounty of fresh and wonderful food, so much that our family of five can’t keep up with the supply. The idea of a farm stand was quickly born, and over one weekend the kids, hubby and I designed and built a simple structure to display our wares and sell the excess to our neighbors.

This also provided us with the perfect opportunity to discuss earning money with our kids. It was decided that each child would have 2 weeks, rotating year round. Each period they were responsible for “working the stand”, which meant gathering eggs, fruits and veggies and collecting money left at the end of the day.

Money they could keep.

In spring, this means fresh flowers from the garden, in fall the stand is filled with butternut squash. They have even sold fertile chicken eggs so others can hatch their own chicks.

Our eldest quickly caught on that the more she put into the stand the more she would get out of it at the end of her week. She threw herself into upgrading signage and displays, adding touches here and there to entice buyers. At the end of each of her weeks she would bank her money, saving for items she wanted to buy, and after a short time she was able to proudly purchase items of her choosing. She got birthday gifts for friends, and asked us to ensure that there were regular deposits to her bank account. Witnessing her having the freedom to make the purchases she wanted was proof to me that teaching our kids that work equals revenue was having a very positive affect on her, and the younger two as well. Their weeks may not pull in quite the haul their sister’s does, but they are catching on and catching up.

Creating a positive relationship with money for our children is one of our responsibilities as a parent, and it is never too late to start the conversation. Right now BMO has an amazing resource (LINK http://talkwithourkidsaboutmoney.com/) to help you get started and open the conversation.

In 2013 BMO Financial Group helped launch the Talk With Our Kids About Money program with the Canadian Foundation for Economic Education, making this it’s 4th year in partnership. BMO’s Talk With Our Kids About Money is a free program accessible to families of any income, and offers tools and resources for parents to help build money conversations into their day-to-day interactions with their kids.

For many, talking about money is a deeply personal thing, and our relationship with money is forged at a young age. BMO is here to help Canadians broach this conversation with youth, and foster financial literacy across Canada.

The third Wednesday in April each year is designated as Talk with our Kids About Money Day, and BMO is hoping to inspire financial literacy conversations across the country. This year on April 20th, BMO wants you to take a moment and have this important conversation with YOUR children, to start building the foundation for a positive relationship with money.

Of course, financial literacy should be a year-round focus for all Canadians, which is why, beyond their partnership with BMO’s Talk With Our Kids About Money Day, BMO also launched YourFinancialLife.com, a site that is available to provide Canadians with financial tips for life events all year long.

Talking about money shouldn’t be stressful, and once we started the conversation with our kids about earning their own money, and taking responsibility for how that happened, things took off all on their own. We are all working the farm together, each of us being rewarded for putting our energy and imaginations into building something we love. Our kids can earn “pocket money” for items above and beyond the regular chores, so that they can feel independent and learn the responsibility of having money to spend. Or money to save.

Take a moment and see how you can open the conversation about money and check out Talk With Our Kids About Money powered by BMO. Money management and a positive relationship with money is one of the most useful skills you can teach your children, so get them started creating a healthy relationship today.

Join the conversation using the hashtag #TWOKAM and make sure to follow BMO on Twitter (@BMO) and on Facebook /BMOCommunity.

This post has been brought to you by BMO but the images and opinions are my own.